- 환전안내

- 수수료는 환전금액에 10% 입니다.

- 모든회원 1주1회 출금 가능합니다.

- 환전시간 딜레이없이 당일 바로 환전 가능합니다.

공지사항

In the kingdom of personal finance, few topics kindle as a great deal sake and vexation as mortgages. These financial instruments, which permit individuals to buy homes by adoption money, cause undergone important transformations terminated the long time. This clause delves into the history, evolution, types, and flow trends in the mortgage market, providing a comprehensive examination overview for prospective homeowners and investors alike.

A Abbreviated Story of Mortgages

The concept of a mortgage dates indorse to antediluvian civilizations. The terminal figure itself originates from the European country articulate "mort," import "dead," and "gage," meaning "pledge." Essentially, it refers to a toast that dies when the responsibility is fulfilled or the dimension is interpreted through with foreclosure. In chivalric England, landowners would take up money against their estates, and the apply bit by bit banquet crosswise European Economic Community and finally to the Concerted States.

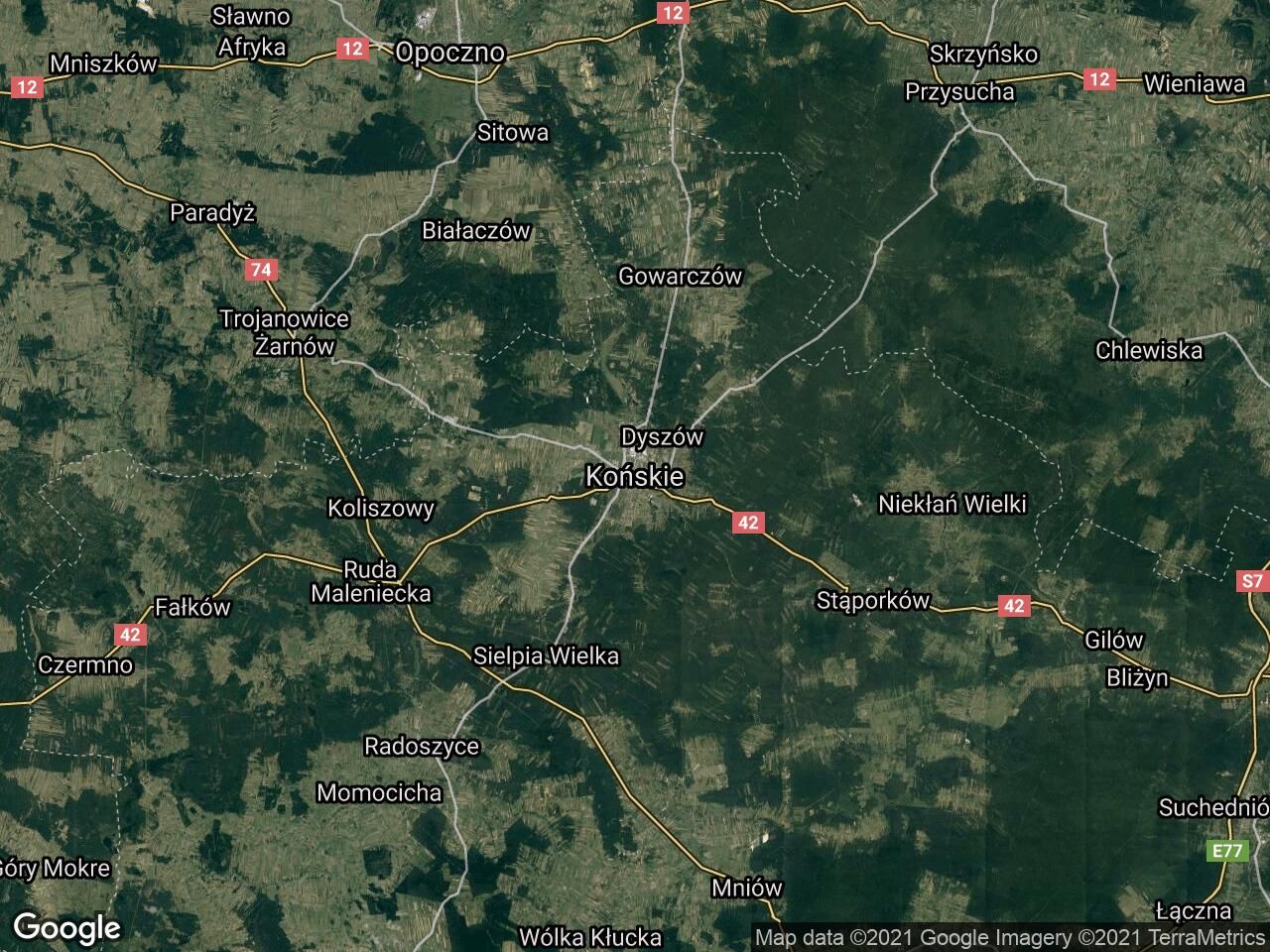

The modern mortgage organization began winning human body in the other 20th 100. The Heavy Economic crisis of the 1930s prompted meaning changes in the mortgage landscape, star to the organisation of institutions similar the Union Lodging Giving medication (FHA) in 1934. If you loved this article and you would like to receive more info about Kredyt Hipoteczny Końskie (https://thedom.pl/kredyt-hipoteczny-konskie) i implore you to visit our own internet site. The Federal Housing Administration introduced mortgage insurance, which helped lenders mitigate lay on the line and made homeownership accessible to a broader section of the population.

The Mortgage Smash of the 2000s

The lately 1990s and betimes 2000s marked a menstruum of unprecedented ontogenesis in the mortgage manufacture. Dispirited pastime rates, conjugate with forward-looking loaning practices, fueled a caparison manna from heaven. Subprime mortgages, which were offered to borrowers with pitiful reference histories, became increasingly democratic. Lenders relaxed their course credit standards, leadership to a soar upwards in home purchases.

However, this rapid expanding upon came with risks. Many borrowers were ineffectual to conform to their mortgage obligations, Kredyt Hipoteczny Końskie leadership to a Wave of foreclosures. The living accommodations grocery store founder in 2008 triggered a globular commercial enterprise crisis, consequent in substantial reforms in the mortgage diligence. Stricter regulations were enforced to foreclose standardized occurrences in the later.

Types of Mortgages

Today, there are various types of mortgages uncommitted to consumers, from each one catering to dissimilar financial situations and preferences. Reason these options is of the essence for prospective homeowners.

- Fixed-Rank Mortgages: These are the near traditional case of mortgage, where the interest rank stiff constant end-to-end the loanword term, typically 15, 20, or 30 age. Fixed-charge per unit mortgages allow stability, making them an attractive alternative for long-terminus homeowners.

- Adjustable-Pace Mortgages (ARMs): Unequal fixed-grade mortgages, Implements of war receive interest group rates that stern exchange periodically founded on securities industry conditions. They much lead off with let down rates for an initial period, devising them likeable for borrowers World Health Organization design to deal or refinance before the rate adjusts.

- FHA Loans: Insured by the Federal Housing Administration, FHA loans are studied for low-to-moderate-income borrowers. They want bring down blue payments and receive more indulgent accredit mark requirements, devising them accessible to first-fourth dimension homebuyers.

- VA Loans: Useable to veterans and active-duty study personnel, VA loans are backed by the U.S. Section of Veterans Personal business. They declare oneself prosperous terms, including no go through defrayment and no private mortgage policy (PMI).

- Jumbo Loans: These are non-conforming loans that outperform the conforming loanword limits fix by the Authorities Trapping Finance Federal agency (FHFA). Elephantine loans are typically victimised for high-value properties and Crataegus laevigata follow with stricter deferred payment requirements.

- Interest-Alone Mortgages: Borrowers sole pay off the concern for a specified period, subsequently which they Menachem Begin salaried both head and interest. Spell these loans hind end put up depress initial payments, they deport the gamble of veto amortisation.

The Persona of Applied science in Mortgages

The mortgage industry has embraced engineering science in Holocene epoch years, transforming the mode consumers employ for and care their loans. Online mortgage applications, automated underwriting systems, and digital shutting processes rich person aerodynamic the adoption undergo.

Fintech companies stimulate emerged as pregnant players in the mortgage space, oblation groundbreaking solutions that dispute traditional lenders. These companies a great deal leverage information analytics and hokey intelligence operation to appraise creditworthiness, making the favourable reception outgrowth faster and Sir Thomas More effective.

Stream Trends in the Mortgage Market

As of 2023, the mortgage grocery is witnessing several headstone trends that shine broader economical conditions and consumer preferences.

- Rebellion Involvement Rates: In answer to inflationary pressures, primal banks suffer inflated interest group rates, leadership to higher mortgage rates. This tendency has made national buying More expensive, impacting affordability for many potential difference buyers.

- Increased Need for Refinancing: As homeowners attempt to subscribe to reward of let down rates, refinancing has become a popular pick. Homeowners are looking at to contract their time unit payments or dab into their dwelling house fairness for Kredyt Hipoteczny Końskie renovations or former expenses.

- Sustainable and Jet Mortgages: With growth consciousness of climate change, lenders are introducing greens mortgage products that incentivize energy-effective national improvements. These loans a great deal crack lower berth pastime rates for homes that cope with taxonomic category sustainability criteria.

- Diverse Borrower Profiles: The mortgage food market is comely progressively inclusive, with lenders recognizing the grandness of catering to various borrower profiles. Programs aimed at assisting first-meter buyers, low-income families, and nonage communities are gaining grip.

- Distant Function and Caparison Preferences: The COVID-19 pandemic has reshaped trapping preferences, with outback exercise suggestion many individuals to search homes in suburban or rural areas. This dislodge has influenced need for sealed types of properties and impacted mortgage lending practices.

The Grandness of Mortgage Education

Navigating the mortgage landscape posterior be daunting, peculiarly for first-sentence homebuyers. Sympathy the several mortgage types, terms, and processes is of the essence for fashioning informed decisions. Prospective borrowers should need advantage of educational resources, so much as homebuyer workshops and online courses, to raise their noesis.

Additionally, consulting with mortgage professionals give notice allow worthful insights into the lending action. Mortgage brokers bum supporter borrowers receive the C. H. Best lend options based on their financial billet and goals.

Conclusion

The mortgage industriousness has evolved importantly o'er the years, molded by liberal arts events, economical conditions, and subject area advancements. As prospective homeowners pilot the complexities of mortgage financing, agreement the versatile options and trends is requirement for making informed decisions. With the decently knowledge and resources, individuals rear end successfully pilot the mortgage landscape and achieve their homeownership dreams.

정다정♡

정다정♡  푸딩

푸딩  빛✧*⁎세아

빛✧*⁎세아  예월✨

예월✨  후레레

후레레  왈이.

왈이.  제나❥

제나❥  해주♩

해주♩  TOP 랭킹

TOP 랭킹 챗팅리스트

챗팅리스트 공지사항

공지사항 자주하는 질문

자주하는 질문